Please allow us to collect data about how you use our website. We will use it to improve our website, make your browsing experience and our business decisions better. Learn more Learn More

Defixrsystem uses a hybrid approach towards assets management process reducing the potential risks through the high levels of capital diversification. The choice of specific investment instruments is carried out by continuousautomated and manual analysis of the effectiveness of both evaluated assets and the Gold backed Assets market as a whole. Defixrsystem uses Coinbase and binance exchange platforms for the trading operations as these platforms offer high liquidity, reliable customer service and high levels of security, as well as the ability to improve the efficiency of the investment decision making process by providing the compatibility with the fund's software systems.

How We Work

Outstanding team

Defixr System is a tightly knit group working together with management teams toward common goals. We have more than 70 investment professionals, including 24 partners with an average tenure at defixr System of more than a decade. This allows us to devote substantial time to the companies in which we invest.Collaborative style

Our objective is to work with portfolio company leadership and create a backdrop in which companies can thrive. We encourage management teams to invest alongside us, and our forward-thinking approach and philosophy to leave companies better than when we found them also means that portfolio company employees often choose to invest alongside Defixr System as well.Alignment of interest

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships.Active Management Across Asset Classes

Defixr System offers regional and global high-active-share equities, fixed income across the yield curve, liquidity solutions backed by four decades of experience as a core capability and, in private markets, real estate, infrastructure, private equity and private debt. Beyond investment management, Defixr System provides engagement in equity and bond markets, proxy voting and policy advocacy.

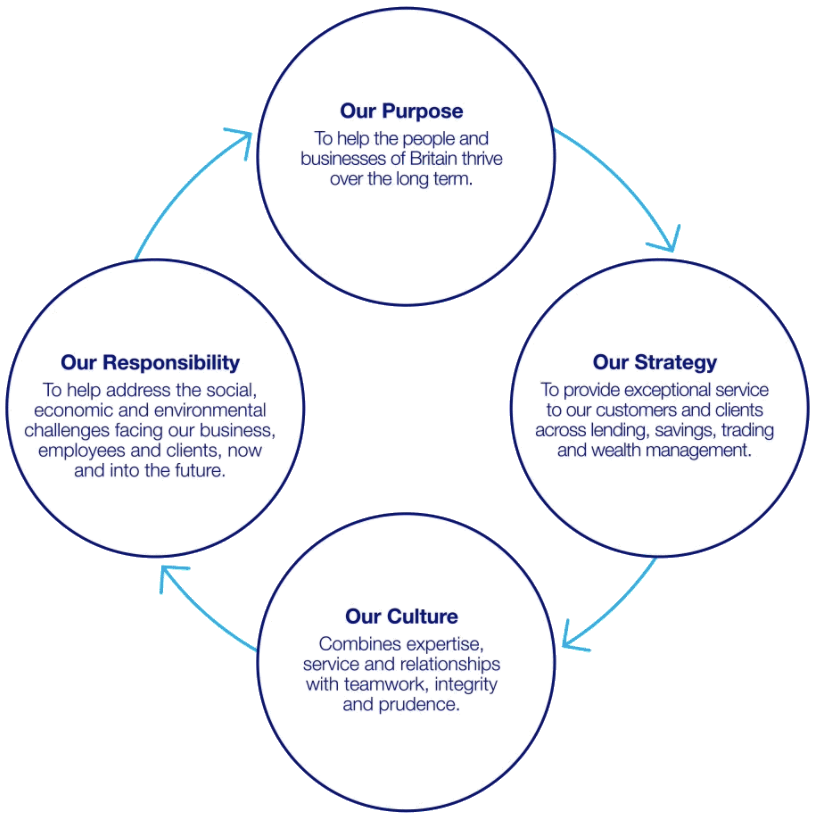

Our Purpose

This means supporting our colleagues, customers and clients, and the communities and environment in which they operate, for the benefit of all our stakeholders. It means helping people and businesses unlock their potential and plan for the future with confidence, building relationships that stand the test of time. And it means that we continue to be there for the long-term, whatever the climate, making decisions that are right for today and for generations to come. To achieve this, our long-term strategic approach place exceptional service at the heart of everything we do. Each of our diverse, specialist businesses have a deep industry knowledge, so they can understand the challenges and opportunities that our customers and clients face. We support the unique needs of our customers and clients to ensure that they thrive, rather than simply survive, whatever the market conditions. We believe in putting our customers and clients first. Our cultural attributes bring out the very best of our people, skills and strong reputation that we have built with our stakeholders over many years. A combination of expertise, service and relationships with teamwork, integrity and prudence underpins our approach and gives us the tools to thrive over the long term. And we recognise that to help the people and businesses of Britain thrive, we also have a responsibility to help address the social, economic and environmental challenges facing our business, employees and clients, now and into the future.Risk management at the center

We seek to manage risk in order to capitalize on opportunities and improve our performance. Disciplined risk estimation and management are deeply integrated components of the investment process across each one of our strategies.We believe a well-constructed portfolio upfront will outperform in good markets and protect our client's capital in difficult markets. For this reason,Defixrsystems has spent over a quarter of a century establishing risk management as a core discipline. This approach begins with a dedicated governance group that oversees risk management. An emphasis on liquid markets, proprietary risk models and a diversified funding structure seeks to further strengthen our approach.

The Defixrsystems way

A dedicated risk management team

Operating independently of the investment businesses, and reporting to the CEO, the Portfolio Construction and Risk Group (PCG) guides the allocation of risk capital. It is supported by a dedicated R&D team to create custom tools and technologies. products.The Risk Management Center

Defixrsystems Risk Management Center provides a comprehensive view of the various investment portfolios and how they fit within pre-established guidelines. Built in 2014, its front-end consists of a 27' by 8' interactive touchscreen designed to visualize data in ways that allow for rapid comprehension. Its back-end systems, which connect to every Defixrsystems office worldwide, continuously run a wide range of operational readiness, risk, and stress test monitors.Run rigorous processes

In pre-trade discussions, the Portfolio Construction and Risk group works to identify the impact of potential trades on a portfolio's risk and stress exposures. In the ex-post analysis, the group evaluates the skill, infrastructure, investment universe, risk and working capital utilization of each business, and uses this information as a part of the risk capital allocation process.Reinforce the culture

A solid framework is important, but successful risk management can only be accomplished when it becomes a central part of the portfolio manager's analysis of potential trades and portfolio construction. Continuous communication and collaboration with the investment teams, combined with an in-depth understanding of the portfolios, play a critical role in maintaining and strengthening our risk culture.Defixrsystem Card

Defixrsystem partnership, aims to fill a gap in the traditional financial system that has left many without access to essential banking products. According to a 2017 survey by the FDIC, 25 percent of U.S. households are unbanked or underbanked, while global numbers have reached a staggering 1.7 billion, according to data released by the World Bank. Through BlockCard, Defixr systemAssociate investors can have a virtual card issued to them while a physical card is mailed to them. The card has a minimum of $1000 balance needed. It can be used at over 45 million merchants and ATMs – anywhere in the world where major credit cards are accepted.

We are pleased to offer a convenient and secure way for you to withdraw your funds - our special card. With this card, you can easily access your funds at ATMs or point-of-sale terminals anywhere that Visa is accepted. Plus, our card is equipped with the latest security features to protect your transactions and keep your money safe. To get started, simply visit the withdrawal section of your account and follow the prompts to request your card. If you have any questions or need assistance, please don't hesitate to contact us.